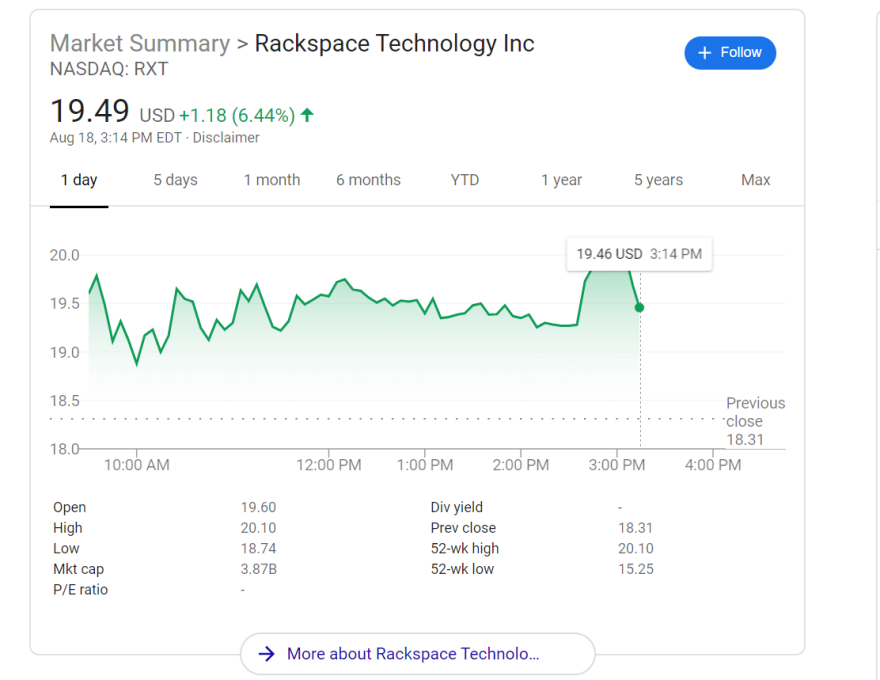

Unconfirmed reports that Amazon may buy a minority stake in Rackspace Technology have bolstered the San Antonio company’s stock price.

Rackspace’s stock shot up more than 17% following news of Amazon’s interest in it.

The anonymously sourced story ran in Reuters Monday. The article points out there isn’t a deal and doesn’t say if “sources” indicate there is interest from Rackspace.

In the short term though, it’s good news for Rackspace, whose stock price hasn’t made a strong impression since reentering the market earlier this month.

After being priced at $21 by the company, it fell on the Nasdaq to around $16, then $15 and has bounced between the two figures since.

Amazon Web Services (AWS) owned about 45% of the global market in public cloud — according to Gartner — so an endorsement like a minority stake would be a meaningful signal to investors. The one-time competitor is now a major source of revenue for Rackspace, whose managed cloud customers often use it.

Even without the deal the company sees Amazon and its mammoth AWS hosting platform as key to its survival. In its stock sale prospectus it said it was “one of the leading consulting partners for Amazon,” listing the number of employee certifications (2,700) and noting it purchased Onica — another Amazon partner — for $323 million in the past year.

Most of Rackspace stock is still owned by Apollo Global Management, which took the company private in 2016 for $4.3 billion.

Rackspace used the proceeds from its $700 million raise to pay down debt, paying off about $600 million. It still has about $3 billion left in debt.

Paul Flahive can be reached at Paul@tpr.org or on Twitter @paulflahive.

TPR was founded by and is supported by our community. If you value our commitment to the highest standards of responsible journalism and are able to do so, please consider making your gift of support today.